Making GPR Prepaid Profitable – New Research & Strategies

New research out of Mercator Advisory Group lays out the harsh reality of GPR prepaid profitability. Already a business with slim margins, the manner in which the Durbin Amendment was implemented resulted in significant decreases in interchange fee revenue, even for programs that were supposed to be exempt from the regulation. Further regulations threaten to decrease interchange revenue even further while market forces have created downward pressure on fee income, such as ATM and monthly service fees. Mercator quantifies this impact in the paper, which can be downloaded here.

The paper correctly argues that program managers can’t afford to maintain the status quo. They need to get creative and seek out new ways to engage with cardholders in an attempt to offset the impact of interchange and fee reductions.

So what’s the magic recipe for forging a path toward profitability? The paper goes into detail about specific strategies, but here are a few high-level points to consider:

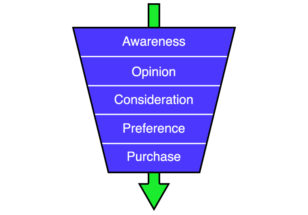

- Identify the different phases along the cardholder life-cycle to increase cardholder engagement.

Being relevant and timely in your communications is a way to create meaningful engagement with cardholders. And if you are able to communicate something that has these characteristics and also supports a revenue-generating activity (such as activation, load, or purchase), you are on to something. The report offers some suggestions for how to match these to different phases of the life-cycle – well worth a read. - Generate new revenue using prepaid mobile apps.

Does your program offer a mobile app? If not, you are missing out on an important channel with which to engage cardholders and create new revenue through partnerships. The paper’s point about revenue-generating partnerships inside of the app is a new idea well worth exploring. - Turn the cardholder support channel from a cost center to a money maker.

We discussed the importance of providing excellent service in a previous post, and we see this topic resurface in this Mercator paper with a slightly different twist. The paper makes the case for using the support channel strategically to create greater engagement by anticipating the cardholder’s needs. Done correctly, this can create a better customer experience while also facilitating profitable behavior.

All in all, this is an eye-opening paper that really puts in perspective how critical it is to start thinking outside of the box. Many of the ideas put forth in the paper require advanced technology to pull off, so those that are tied to legacy processing platforms may find that their hands are tied. But long-term, all companies will need to find a way to support the strategies recommended by Mercator.

What is your organization doing to create new revenue and engage cardholders in the post-Durbin era? We would love to learn from your ideas!