5 Ways A Multi-Currency Debit Solution Can Grow Your Business

Debit cards have been around for a long time. With worldwide circulation exceeding 8 billion and a 9.4% increase over last year (nearly 895 million more debit cards), they are here to stay (Nilson Report, May 2017).

But multi-currency debit cards are a new innovation not widely offered, especially in North America, and it may be just what your business needs to keep high-value customers in your portfolio, add more value, and drive revenue growth.

A multi-currency debit card solution offers many benefits for issuers:

1. Solves A Key Business Challenge

Multiple cards and multiple currencies are inconvenient and expensive for consumers and issuers. Presently, travelers must carry debit cards which correspond to the native currencies wherever they are traveling – and issuers must support the expense and administration entailed with this 1:1 relationship. This results in increased complexity, higher servicing costs, and a very poor customer experience. A multi-currency debit card solution consolidates currency values onto a single card which can then be tapped at any time through multiple purses – and cardholders can lock in exchange rates when they are favorable.

2. Engages Frequent Business Travelers

High net-worth banking clients tend to be frequent business travelers as well. Issuers can enhance their brand value with this potentially lucrative customer segment by utilizing a unique and valuable multi-currency debit card solution. They can also create opportunities to offer highly personalized, meaningful rewards while concurrently providing real-time alerts on account changes.

3. Distinguishes Issuer Brand

With numerous cards carrying different currencies and multiple brands in a traveler’s wallet, distinguishing an issuer’s brand is extremely challenging. The integration of multiple currencies on to a single card provides a welcome answer to many travelers’ woes — and will set an issuer’s brand apart. The best part is there’s nothing like it currently in the market, so issuers can achieve first-mover advantage if they act quickly.

4. Grows Revenue

In addition to offering convenience to cardholders, issuers can tap foreign exchange fees as a new revenue source with a multi-currency debit card solution. Transparent exchanges have also been proven to increase tickets and drive additional sales.

5. Creates Lasting Value

With the ability to select favorable exchange rates, safely extend access to debit account purses to traveling companions, and reduce the number of plastic cards in their wallets, high-value travelers have more reasons to stay loyal to an issuer’s brand.

A multi-currency debit card solution offers a safe and convenient solution for travelers, with features like alerts, digital integration, and companion cards that provide distinct consumer value.

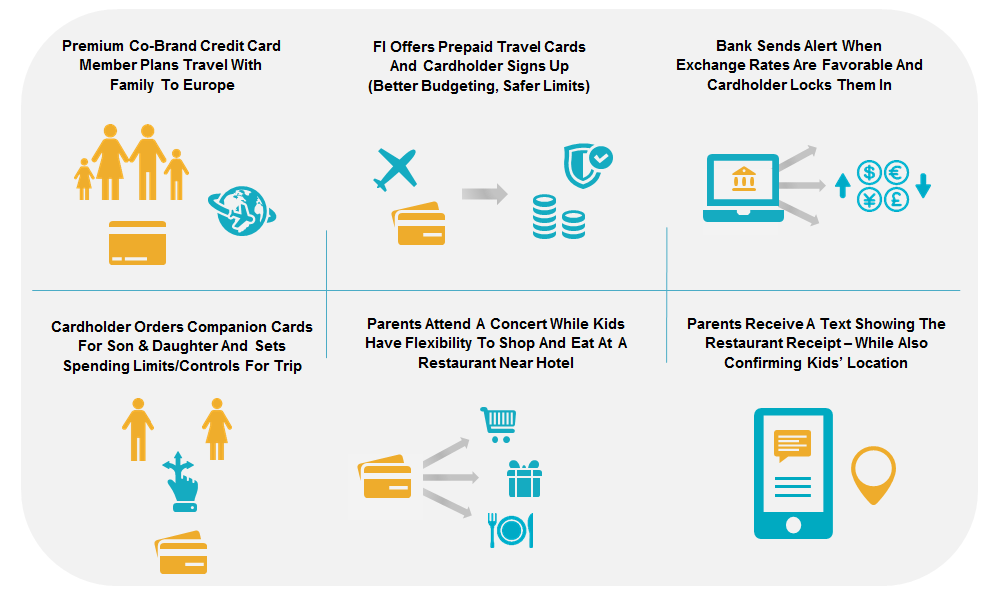

The use case in the following illustration demonstrates the flexibility and convenience the solution provides to a family in managing its spending and budget while on vacation:

Use Case: i2c’s Multi-Currency Debit Solution in Action