What Is Remote Deposit Capture? A Quick Overview

Remote deposit capture (RDC), also known as remote check deposit, is a financial technology that streamlines check processing. RDC enables customers to scan or upload a check image and make deposits remotely using their mobile device.

Mobile Check Deposit vs. Paper Check Deposit

A 2020 Insider Intelligence’s 2020 US Mobile Banking Competitive Survey found that 79.5% of mobile banking users said mobile is their primary banking channel. Online banking (22.8%), bank tellers (21%), ATMs (19.5%) and telephone banking (2.4%) rounded out the study.

That means mobile devices have become the primary method U.S. banking customers rely on to carry out their banking needs. For even more perspective, 54% of consumers use digital banking tools more now than they did in 2020.

Financial institutions are well-positioned to offer features like remote image deposit now more than ever! Banks and credit unions can leverage RDC to meet customer demand and provide remote online deposit benefits:

- Customer convenience

- Streamlined efficiencies for check processing

- Share of wallet and brand preference

Mobile remote deposit saves time for customers, eliminating trips to the bank. Manual check processing can be prone to errors, and it’s limited to available business days and bank hours, unlike remote deposit capture where consumers can make deposits anytime and from anywhere.

Customers Value Mobile Banking

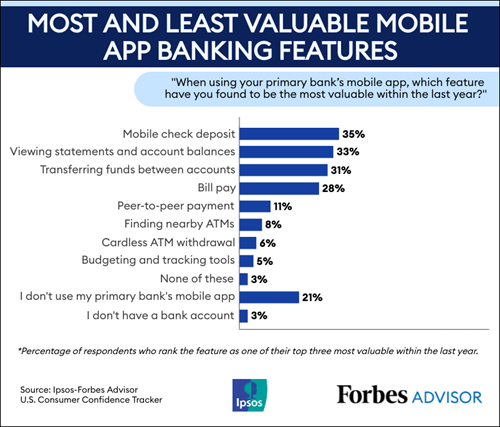

With mobile remote deposit capture, banks can tap into customer preference without having to drive preference. A 2021 survey found that “roughly three in four Americans (76%) used their primary bank’s mobile app within the last year for everyday banking tasks.” By contrast, “only 21% of survey respondents said they didn’t use their bank’s app.”

The survey results confirm the value of mobile remote deposit capture: “More than a third of respondents (35%) rated mobile check deposit as one of their top three most valuable features over the last year.”

i2c’s Mobile Remote Deposit Capture Solution

i2c’s Mobile Remote Deposit Capture solution enables issuing banks to simplify the check deposit process for their customers through the i2c white label mobile banking app.

To make a deposit, bank customers simply follow the app instructions and use their phone’s camera to capture the front and back images of a check. Customers then use the mobile app to send the images to i2c for processing. Finally, i2c coordinates settlement with the bank’s settlement account and enables them to use funds from the deposited check for spending anywhere their payment is accepted.

When our clients use the i2c Mobile Remote Deposit Capture solution, they are positioned to compete with any financial institution around the world by utilizing a global issuing platform. Contact us to get started.