Six Ways to Improve Airline Frequent Flyer Card Programs (Infographic)

In many ways, the major U.S. airlines have organized themselves into two distinct businesses. The first is the traditional business with jets, which involves selling seats at the most profitable price possible, collecting baggage fees, and selling food and drinks while keeping a close eye on costs. The other business is the sale of loyalty program miles to banks, merchants, shopping portals, dining portals and other travel-related companies.

The latter has grown so much that it accounts for more than half of all profits for some airlines.

“Airlines are earning upwards of 50 percent of [their income] from selling miles to a credit card company,” said Joseph DeNardi, a senior airline analyst with Stifel Financial Corp.

A report from Bloomberg notes that airlines are receiving an estimated 1.5 cents to 2.5 cents for each mile they sell to banks, while the cost of fulfilling redemptions can be as low as one-third of that. This means that the margin on miles is as much as 60% to 70% on the billions of miles being sold by the airlines.

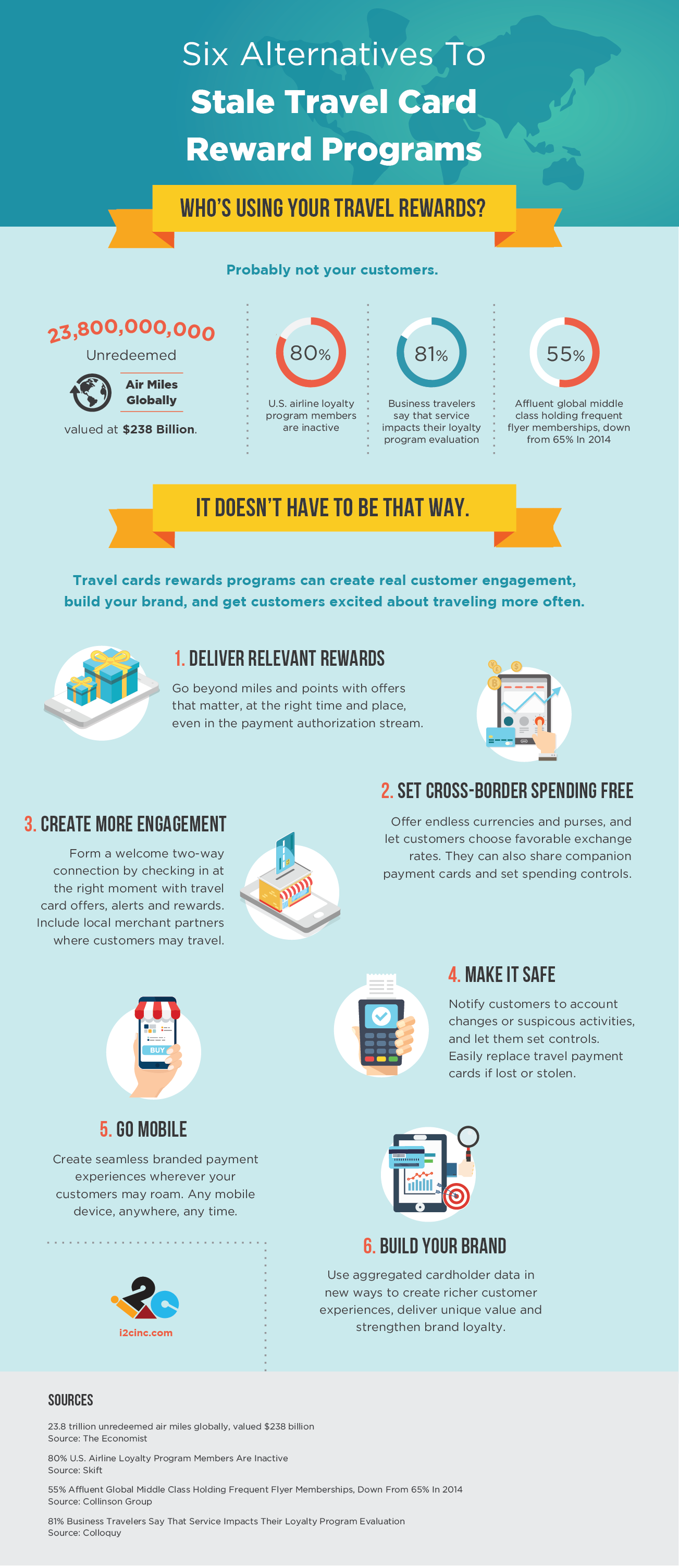

Despite frequent flyer programs’ profitability, the ceiling can easily be even higher. 23.8 trillion frequent flyer miles go unredeemed globally, which The Economist values at approximately $238 billion. And according to Skift, 80% of U.S. airline loyalty program members are inactive.

Clearly, there is vast room for improvement. By combining existing airline loyalty programs and sophisticated payments features on a single multi-function travel card, an innovative frequent flyer payment card solution provides tremendous benefits to airlines and their customers.

Multi-Currency Convenience for Travelers, 100% Customer Engagement for Airlines

It gives travelers a convenient way to make multi-currency payments and budget spending while concurrently earning loyalty points. At the same time, it offers airlines a novel way to reinvigorate their frequent flyer programs by engaging 100% of their customer base with innovative payment solutions, helping turn the marketing expense of maintaining loyalty programs into a revenue-generating vehicle.

The following infographic illustrates six ways that an integrated frequent flyer reward and payment travel card solution can create real customer engagement, build brand loyalty, and motivate customers to travel more often:

An integrated air miles reward and prepaid travel card solution offers consumers benefits that are hard for other cards to duplicate, and it can breathe new life into an airline’s frequent flyer programs.

To learn more about i2c’s integrated loyalty and payments card solution, visit https://www.i2cinc.com/solutions/frequent-flyer/